The legal framework governing background checks in the US is complex, primarily shaped by the Fair Credit Reporting Act (FCRA) at the federal level and varying state-specific laws. Compliance with these regulations, including privacy laws, is crucial for organizations to conduct legal and ethical checks while protecting individuals' rights to privacy. Understanding the interplay between FCRA standards and state mandates is essential for effective background check protocols, ensuring integrity and confidentiality throughout the process.

In today’s world, comprehensive background checks are essential for businesses and organizations across various sectors. However, navigating the intricate web of state laws governing these checks is crucial for ensuring compliance and protecting sensitive data. This article delves into the critical legal aspects of background checks, exploring state-specific legislation that shapes their conduct. We analyze the Fair Credit Reporting Act (FCRA) and its role in standardization while also highlighting privacy laws designed to safeguard individual information during the process. By understanding these legal requirements, entities can efficiently manage background checks while maintaining compliance.

- Understanding the Legal Framework of Background Checks

- State-Specific Laws and Their Impact on Compliance

- The Fair Credit Reporting Act (FCRA) and Its Role

- Privacy Laws: Protecting Individual Data During Checks

- Navigating Legal Requirements for Efficient and Compliant Checks

Understanding the Legal Framework of Background Checks

Background checks are a crucial aspect of many aspects of daily life in the United States, from employment to housing and even volunteer work. However, understanding the legal framework behind these checks is essential for both individuals and organizations alike. The Fair Credit Reporting Act (FCRA) serves as the primary legislation governing background checks, outlining the rules and regulations that companies must adhere to when conducting consumer reports, including criminal history checks.

Compliance with FCRA and other relevant privacy laws is paramount to ensure the legal validity of background checks. These laws protect individuals’ rights to privacy by dictating how personal information can be collected, used, and disclosed. For employers, understanding these legal requirements is critical to prevent discrimination and ensure fair hiring practices. Similarly, organizations conducting background checks for other purposes must stay informed about state-specific background check laws, which can vary significantly across the country.

State-Specific Laws and Their Impact on Compliance

Each state has its own set of rules and regulations when it comes to background checks, which can significantly impact compliance for businesses operating across multiple jurisdictions. The Fair Credit Reporting Act (FCRA) sets federal guidelines for background check processes, but states often have additional legal aspects that must be considered. These include specific requirements for data collection, storage, and usage, as well as privacy laws that protect individuals’ sensitive information.

For instance, some states mandate the inclusion of certain types of offenses or restrictions in a background check report, while others have stringent rules regarding the release of such reports to third parties. Compliance with these state-specific laws is crucial to avoid legal repercussions and maintain a positive reputation. Businesses must stay informed about the evolving legal requirements of checks in each location they operate to ensure their background check processes are in line with local regulations.

The Fair Credit Reporting Act (FCRA) and Its Role

The Fair Credit Reporting Act (FCRA) plays a pivotal role in governing the legal aspects of background checks in the United States. This comprehensive legislation sets forth rules and regulations that ensure fairness, accuracy, and privacy during the process of checking an individual’s credit history or consumer information. By establishing uniform standards, the FCRA promotes compliance in background checks, ensuring that employers, lenders, and other entities adhere to strict legal requirements.

Under the FCRA, consumers have the right to access their own credit reports and to challenge any inaccurate or fraudulent information. It also imposes duties on background check providers to obtain written consent from individuals before conducting searches, maintain accurate records, and disclose the presence of third-party involvement. These privacy laws surrounding background checks are designed to safeguard an individual’s sensitive data and prevent unauthorized access, ensuring a balance between the need for comprehensive checks and protecting personal privacy rights.

Privacy Laws: Protecting Individual Data During Checks

Privacy Laws play a pivotal role in the legal aspects of background checks, ensuring that individual data is handled with utmost care during the verification process. These laws, such as the Fair Credit Reporting Act (FCRA), are designed to safeguard personal information from unauthorized access or misuse. When conducting background checks, compliance with these regulations is crucial to maintain the accuracy and confidentiality of sensitive data.

The FCRA, for instance, imposes strict guidelines on how consumer reports, including criminal records and personal history, can be obtained and utilized. It mandates that businesses and organizations conducting background checks obtain written consent from individuals before accessing their credit or consumer reports. This ensures that individuals are aware of the information being collected and its intended use, providing them with control over their data. Additionally, these laws establish procedures for disputing inaccurate information, protecting individuals from potential privacy invasions during the background check process.

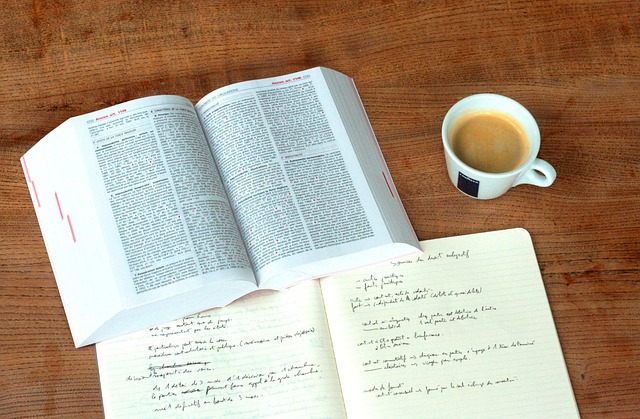

Navigating Legal Requirements for Efficient and Compliant Checks

Navigating the legal landscape surrounding background checks is a complex task, especially with varying state laws and regulations. Each jurisdiction has its own set of rules regarding what information can be accessed, how it’s used, and who has the authority to request it. Compliance with these laws is paramount to ensure the integrity of the process and protect individuals’ privacy rights.

The Fair Credit Reporting Act (FCRA) serves as a cornerstone for background check regulations, dictating the procedures for gathering and handling consumer reports. Beyond FCRA, state-specific privacy laws further refine the process. For instance, some states mandate specific notices be provided to individuals before conducting checks, while others restrict the dissemination of certain data. Understanding these legal aspects is crucial to designing efficient background check protocols that align with compliance standards.